U.S. accuses #Rwanda of violating peace deal as #M23 rebels seize key city in eastern #Congo.

The remarks by U.S. Ambassador to the United Nations Mike Waltz came as more than 400 civilians have been killed since the Rwanda-backed M23 rebels escalated their offensive in eastern Congo’s South Kivu province, according to regional officials who also say that Rwandan special forces were in the strategic city of Uvira.

Waltz told the UN Security Council that the U.S. is “profoundly concerned and incredibly disappointed with the renewed outbreak of violence” by M23.

“Rwanda is leading the region towards increased instability and war,” Waltz warned. “We will use the tools at our disposal to hold to account spoilers to peace.”

He called on Rwanda to respect Congo’s right to defend its territory and invite friendly forces from neighbouring Burundi to fight alongside Congolese forces. He also said the U.S. is engaging with all sides “to urge restraint and to avoid further escalation.”

M23’s latest push

The rebels’ latest offensive comes despite a U.S.-mediated peace agreement signed last week by the Congolese and Rwandan presidents in Washington.

The accord didn’t include the rebel group, which is negotiating separately with Congo and agreed earlier this year to a ceasefire that both sides accuse the other of violating. However, it obliges Rwanda to halt support for armed groups like M23 and work to end hostilities.

The rebels’ advance pushed the conflict to the doorstep of neighboring Burundi, which has maintained troops in eastern Congo for years, heightening fears of a broader regional spillover.

Congo’s ministry of communication confirmed in a statement Friday that M23 has seized the strategic port city of Uvira in eastern Congo, on the northern tip of Lake Tanganyika and directly across from Burundi’s largest city, Bujumbura.

Uvira was Congo’s government’s last major foothold in South Kivu after the provincial capital of Bukavu fell to the rebels in February. Its capture allows the rebels to consolidate a broad corridor of influence across the east.

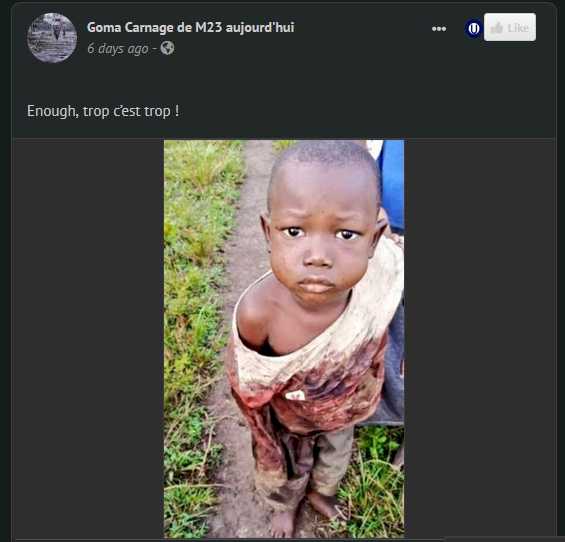

M23 said it had taken control of Uvira on Wednesday afternoon, following a rapid offensive since the start of the month. Along with the more than 400 killed, about 200,000 have been displaced, regional officials say.

Concerns over an escalation

Civilians fleeing eastern Congo have also crossed into Burundi, and there have been reports of shells falling in the town of Rugombo, on the Burundian side of the border, raising concerns about the conflict spilling over into Burundian territory.

More than 100 armed groups are vying for a foothold in mineral-rich eastern Congo, near the border with Rwanda, most prominently M23. The conflict has created one of the world’s most significant humanitarian crises, with more than seven million people displaced, according to the UN agency for refugees.

Congo, the U.S. and UN experts accuse Rwanda of backing M23, which has grown from hundreds of members in 2021 to around 6,500 fighters, according to the UN.

Waltz said Rwandan forces have provided “logistics and training support to M23” and are fighting alongside the rebels in eastern Congo, with “roughly 5,000 to 7,000 troops as of early December.”

Congo calls for more pressure on Rwanda

Congo’s Foreign Minister Therese Kayikwamba Wagner accused Rwanda of trampling on the peace agreement, which she described as bringing “hope of a historic turning point.”

She warned, however, that the “entire process … is at stake,” and urged the Security Council to impose sanctions against military and political leaders responsible for the attacks, ban mineral exports from Rwanda and prohibit it from contributing troops to UN peacekeeping missions.

“Rwanda continues to benefit, especially financially but also in terms of reputation, from its status as a troop-contributing country to peacekeeping missions,” Wagner told The Associated Press.

Rwanda currently is one of the largest contributors of UN peacekeepers, with nearly 6,000 Rwandan troops.

Wagner also said economic agreements signed with the Trump administration as part of the peace deal will hinge on stability. “We have told our American partners that we cannot envision any path toward shared economic prosperity without peace,” she told the AP.

Eastern Congo, rich in critical minerals, has been of interest to Trump as Washington looks for ways to circumvent China to acquire rare earths, essential to manufacturing fighter jets, cell phones and more.

Wagner said the economic partnership is still at an early stage.

“Everything will start to take shape and become much more tangible once the joint governance mechanisms are put in place,” she said. “What we want is a win-win partnership ... far beyond the single issue of minerals and their transfer,” she added.

Rwanda accuses Congo of ceasefire violations

Rwanda’s Ambassador to the UN Karoli Martin Ngoga accused Congo of repeatedly breaking the ceasefire. He also accused the Congolese government of supporting the mostly Hutu Democratic Forces for the Liberation of Rwanda, which “threatens the very existence of Rwanda and its people.”

Nearly two million Hutus from Rwanda fled to Congo after the 1994 Rwandan genocide that killed 800,000 Tutsi, moderate Hutus and others. Rwandan authorities have accused Hutus who fled of participating in the genocide, alleging that the Congolese army protected them.

“Rwanda reiterates its full commitment to implement its part of the agreement,” Ngoga told the Security Council.

While Rwanda denies the claim that it backs M23, it acknowledged last year that it has troops and missile systems in eastern Congo, allegedly to safeguard its security. UN experts estimate there are up to 4,000 Rwandan forces in Congo.

___

Banchereau reported from Dakar, Senegal. Associated Press writer Jean-Yves Kamale in Kinshasa, Congo contributed to this report.

Edith M. Lederer And Mark Banchereau, The Associated Press

Global News on Umojja.com